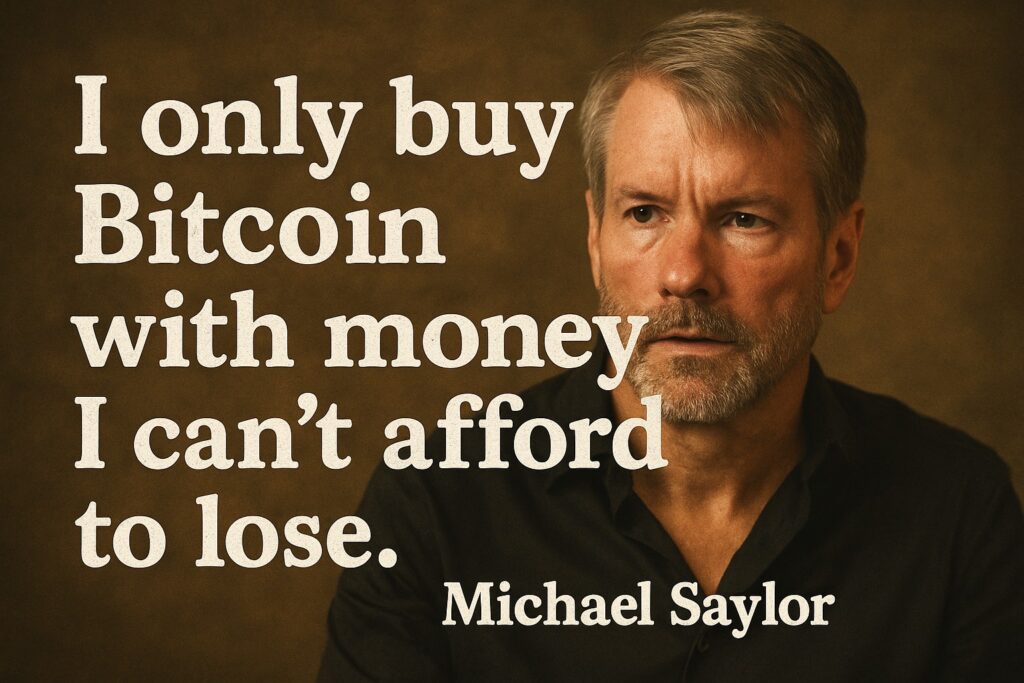

TYSONS CORNER, Va., May 25, 2025 – Michael Saylor, co-founder and executive chairman of Strategy (formerly MicroStrategy), is still strongly supporting Bitcoin. On May 25, 2025, he posted on X (@saylor):

“I only buy bitcoin with money I can’t afford to lose.”

He also shared a chart showing that Strategy now owns 576,230 Bitcoins, worth around $62 billion.

The chart (from SaylorTracker) shows the company has been buying Bitcoin since 2020. They’ve paid an average of $69,749.58 per Bitcoin. Right now, the value of their Bitcoin has gone up by 54.26%, meaning a profit of about $21.8 billion.

How Much Did They Buy in May 2025?

Between April 28 and May 25, 2025, Strategy increased its Bitcoin from 553,555 BTC to 576,230 BTC. That means they bought 22,675 BTC in May. At an average price of about $107,487 per Bitcoin, that adds up to around $2.44 billion spent this month.

This fits with Strategy’s ongoing plan to keep buying more Bitcoin. In early May, reports showed Saylor hinted at more purchases after the company’s Q1 2025 earnings call. On April 28 alone, they bought 15,355 BTC worth over $1.4 billion.

A Closer Look at Their Bitcoin Plan

Since 2020, Strategy has focused heavily on Bitcoin. The chart in Saylor’s post shows:

- Orange dots = each Bitcoin purchase

- Blue line = market price of Bitcoin

- Green line = average price Strategy paid

In 2025, they’ve made even more big purchases, showing their belief that Bitcoin is a good long-term investment—even if the market is unpredictable.

Even though the company’s revenue in Q1 2025 dropped to $111 million (down 3.6% from last year), and they’re facing a lawsuit over their Bitcoin claims, Saylor is staying confident. Strategy also raised their goals for 2025:

- “BTC Yield” target increased from 15% to 25%

- “BTC $ Gain” target raised from $10 billion to $15 billion

What People Are Saying

Saylor’s post got a lot of attention online.

- @Bitcoin_for_Freedom said the move was “bullish”

- @HODL15Capital shared a table showing how Strategy’s Bitcoin stack compares to others

But not everyone was supportive.

- @LogicalFool1 reminded people that MicroStrategy’s stock once dropped from $313 to $1 in 2000, warning of risks in Saylor’s bold plan.

What’s Next?

Strategy’s Bitcoin is now a major part of the company’s total value. They’ve been raising money through selling shares (like the $21 billion ATM offering earlier this year) to keep buying Bitcoin. But selling more shares also lowers the value for existing shareholders.

As the company faces legal and market challenges, Saylor’s strong belief in Bitcoin is still front and center. Whether it will keep paying off—or bring more trouble—remains to be seen. For now, Strategy and Saylor are going all in on Bitcoin.

You can see Saylor’s original post here: