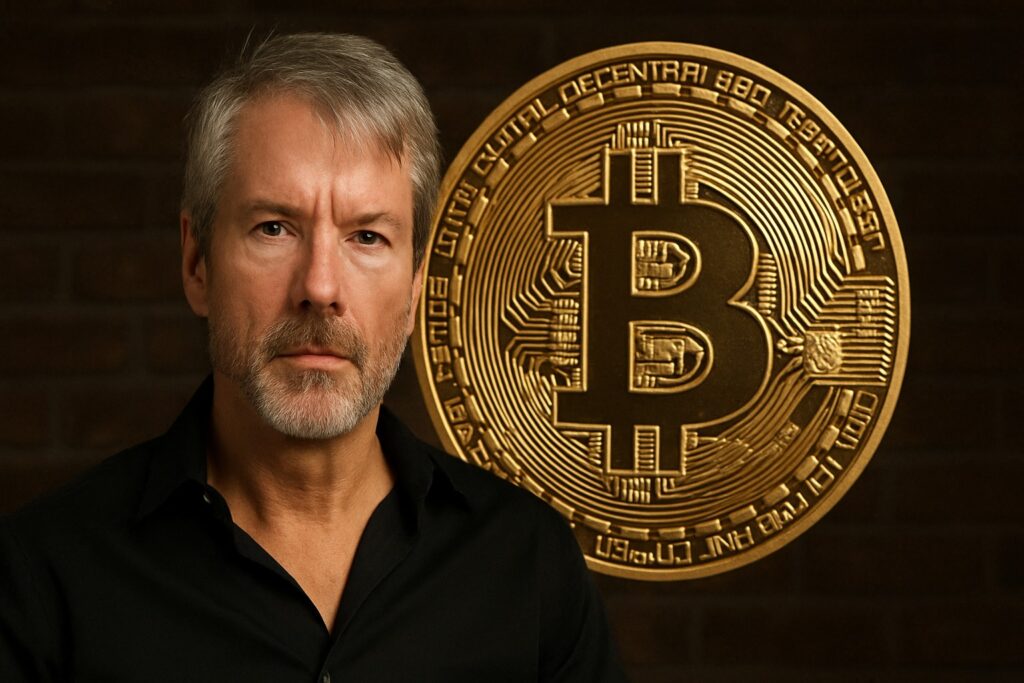

Tysons Corner, Virginia, May 25, 2025 – Michael Saylor, the co-founder and chairman of Strategy (formerly MicroStrategy), is once again in the news in the Bitcoin world. He posted a post on X (

@saylor) on May 25, 2025, writing, “I only buy Bitcoin with money I don’t care about losing.” Along with this, he also shared a chart showing the value of Strategy’s Bitcoin, which is now $ 62 billion (about Rs 5.1 lakh crores) and he owns 576,230 Bitcoins.

This chart shows how many Bitcoins Strategy has bought since 2020. His average purchase price is $ 69,749.58 (about Rs 5.8 lakhs) per Bitcoin. So far, their bitcoin holdings have gained 54.26%, or about $21.8 billion (about Rs 1.8 lakh crore). Strategy bought more bitcoins in May 2025, making it the world’s largest bitcoin holding company.

How many bitcoins did Strategy buy in May 2025?

Based on web results and X posts, Strategy had 553,555 bitcoins on April 28, 2025, which increased to 576,230 bitcoins by May 25, 2025. This means that in May they bought 22,675 more bitcoins. At the average price of $107,487.47 (about Rs 9 lakh) for one bitcoin, these purchases were worth about $2.44 billion (about Rs 20,000 crore).

Strategy has already been investing heavily in bitcoin. A report in early May said that Strategy has been buying bitcoin continuously. On April 28, he bought 15,355 bitcoins for $1.4 billion (roughly Rs. 11,500 crores).

Strategy’s Bitcoin strategy

Strategy started investing in bitcoin in 2020, and his holdings have grown a lot since then. The chart in the post shows when he bought bitcoins (orange dots), the average market price of bitcoin (blue line), and the average price of his purchases (green line). His purchases have accelerated in 2025, as he believes bitcoin will increase in value in the long run.

However, Strategy’s Q1 2025 revenue was $111 million (roughly Rs. 920 crores), down 3.6% from last year. Also, he is facing a lawsuit that he exaggerated the benefits of his bitcoin strategy. Still, Saylor remains bullish on bitcoin. The company has raised its “BTC Yield” target for 2025 from 15% to 25% and “BTC $ Gain” target from $10 billion to $15 billion.

People reacted

The crypto community reacted differently to Saylor’s post. @Bitcoin_for_Freedom called it “bullish” (positive), and

@HODL15Capital

shared a table comparing the strategy’s bitcoin holdings to others. But some are also raising questions—

@LogicalFool1

reminded that MicroStrategy’s stock fell from $313 to $1 in 2000, meaning there is risk.

What’s next?

The strategy’s bitcoin holdings are a big part of their balance sheet. The company raises money by selling shares and buys bitcoin with it, which has caused some losses to shareholders. But the seller and the strategy are strong believers in Bitcoin. It will be interesting to see how successful his strategy will be in the future.