May 22, 2025 – Bitcoin has surprised everyone once again. On May 22, its price reached $110,750, which is the highest level ever. Its price was $74,441 in early April, but now it has gone above $110,000. The biggest reason for this is the tremendous interest of big companies and investors. Along with this, the shortage of bitcoin in the market and good economic conditions are also increasing this boom.

Quick Takes

Bitcoin reached $110,750, the highest price ever — driven by massive buying by large companies and investors.

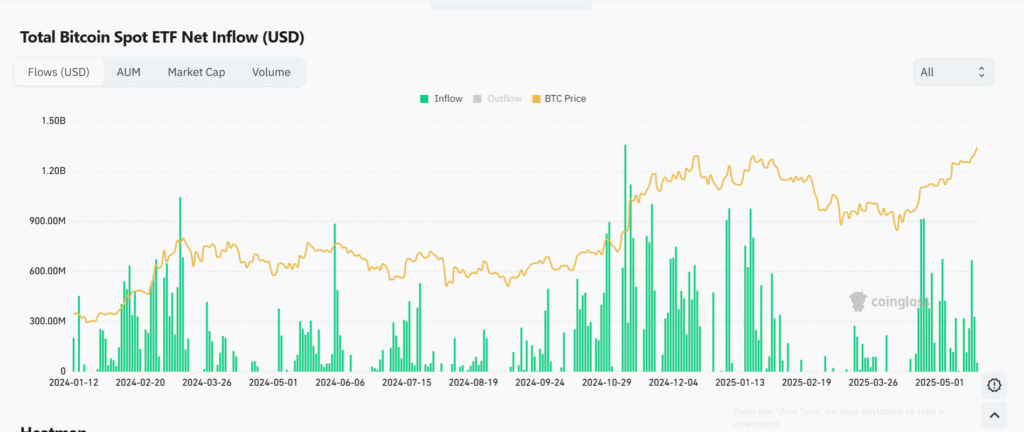

Record investment in US Bitcoin ETF — over $2.8 billion invested in May 2025, creating huge demand for Bitcoin in the market.

Institutional and corporate investment has grown rapidly — companies like Goldman Sachs, Strategy and Japan’s Metaplanet are considering Bitcoin as a strategic asset.

Increased demand from ETF

In the US, Bitcoin ETF (a type of investment fund) has played a big role in this boom. In the first two weeks of May 2025, more than $2.8 billion (about ₹23,000 crores) was invested in them. The most money went to BlackRock‘s IBIT scheme – about $4.4 billion. On May 9 alone, $356 million was purchased in it. Fidelity‘s FBTC scheme has also seen increased investor interest.

ETF funds bought 26,700 bitcoins in May, while mining produced only 7,200 bitcoins. This led to a shortage of bitcoins on the market, and prices rose sharply. These ETFs now hold more than $122 billion in assets combined.

Who is buying?

Big companies and investors are now investing in bitcoin ETFs:

- Goldman Sachs bought 30.8 million shares of IBIT earlier this year, worth about \$1.4 billion.

- The firm also holds $315 million worth of shares in Fidelity’s ETF.

- Strategy (formerly MicroStrategy) has bought 7,390 more bitcoins, worth about $765 million.

- Japan’s Metaplanet company has also bought 1,004 bitcoins and now has a total of 7,800 bitcoins.

This shows that companies are now considering bitcoin as an important asset, like gold or the dollar.

Why such a boom?

There are many reasons behind the increase in the price of bitcoin:

- Bitcoins in the market have decreased – only 2.6 million bitcoins are available on exchanges. Most people are keeping them in a safe place instead of selling them.

- Most investors are in profit – about 94.7% of bitcoin holders are in profit, which is increasing confidence.

- Fear of inflation – Inflation may increase due to some policies, and people are considering bitcoin as a safe option.

- Government support – The Trump administration’s pro-crypto policies, such as the launch of the World Liberty USD stablecoin, have excited the market.

Some experts believe that if the situation remains the same, Bitcoin could reach $200,000 by the end of 2025. And by 2029, it could even reach $1 million (over ₹8 crores).

What could happen next?

This boom in Bitcoin is showing no signs of stopping at the moment. People are expecting that its price will increase further. But the cryptocurrency market is very volatile, so investments should be made wisely.

At the moment, Bitcoin is proving to the world that it has become a strong and reliable asset.

“Bitcoin doesn’t care about your doubts — it makes its own rules.”

Note: Investing in crypto can be risky. Be sure to do your homework and consult an expert before investing.

Also Read : Kiyosaki said that it can go up to $1 million